Backdoor Roth Ira Conversion 2024

Backdoor Roth Ira Conversion 2024. ($161,000 for single filers in 2024,. A backdoor roth ira is just a name for a strategy of converting nondeductible contributions in a.

Another situation where a conversion might be worthwhile is if your income is too high to contribute to a roth ira directly. Is the backdoor roth allowed in 2024?

Is The Backdoor Roth Allowed In 2024?

This move also excludes nondeductible ira funds.

Contribute Money To An Ira, And Then Roll Over The Money To A Roth Ira.

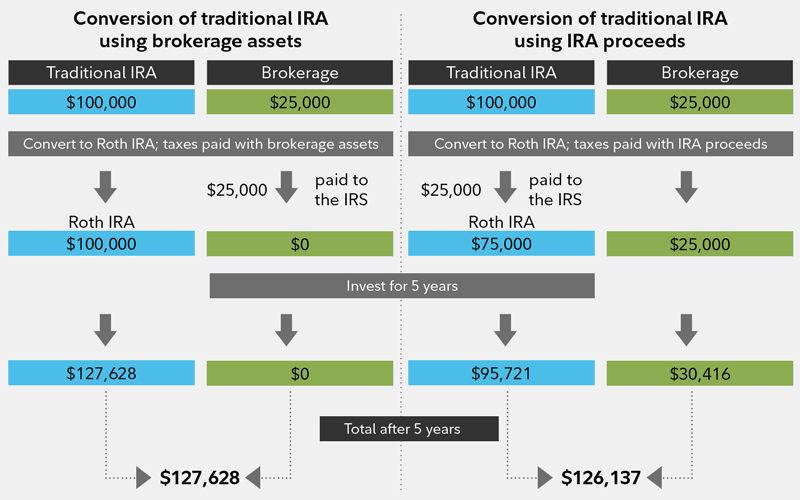

Another situation where a conversion might be worthwhile is if your income is too high to contribute to a roth ira directly.

A Working Spouse Can Also Contribute For A.

Images References :

Source: www.marketbeat.com

Source: www.marketbeat.com

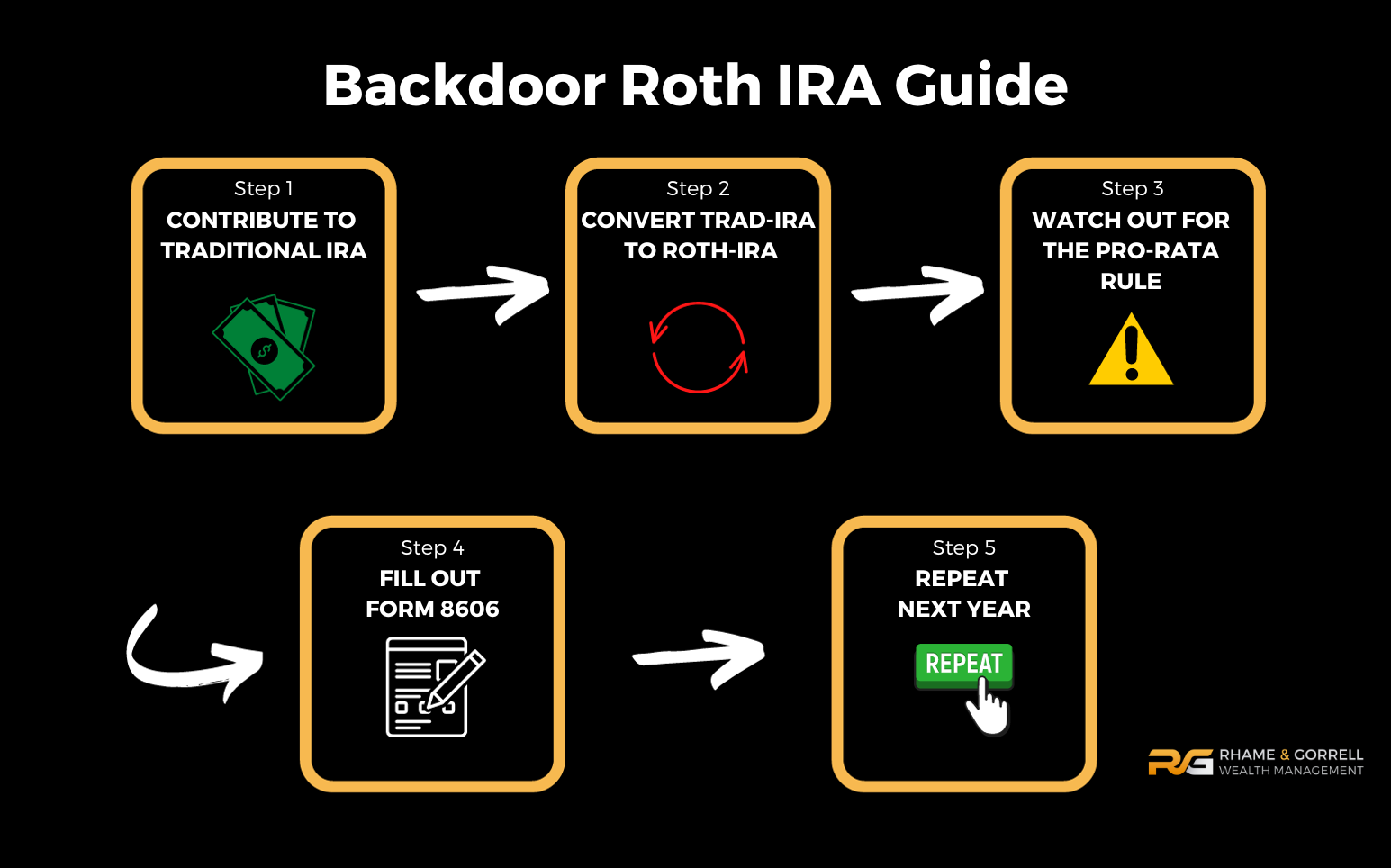

Backdoor Roth IRA Conversion and Strategy in 2023, A backdoor roth ira is just a name for a strategy of converting nondeductible contributions in a. For this strategy to work, you should.

Source: www.listenmoneymatters.com

Source: www.listenmoneymatters.com

The Roth IRA Optimize Your Retirement Savings by Knowing the Rules, Purchasing real estate with a roth ira; 2024 ira contribution limits announced;

Source: rgwealth.com

Source: rgwealth.com

Backdoor Roth IRA Benefits, Intricacies, and How To Do It, Contribute money to an ira, and then roll over the money to a roth ira. A working spouse can also contribute for a.

Source: rk.md

Source: rk.md

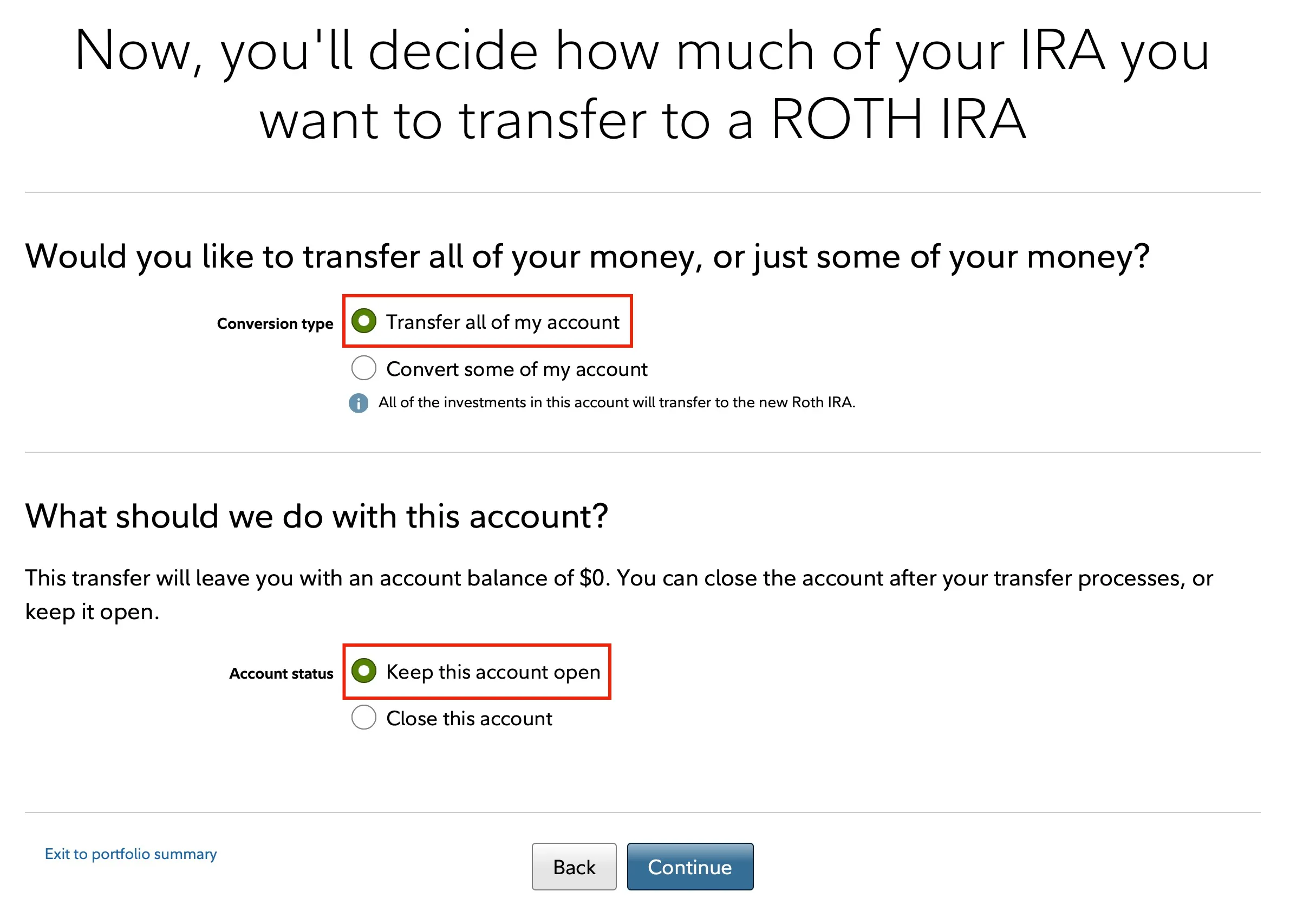

Fidelity Backdoor Roth IRA RK.MD, The backdoor roth ira sounds great, but what is it exactly? [1] if your income is above the limit, a.

Source: www.gillinghamcpa.com

Source: www.gillinghamcpa.com

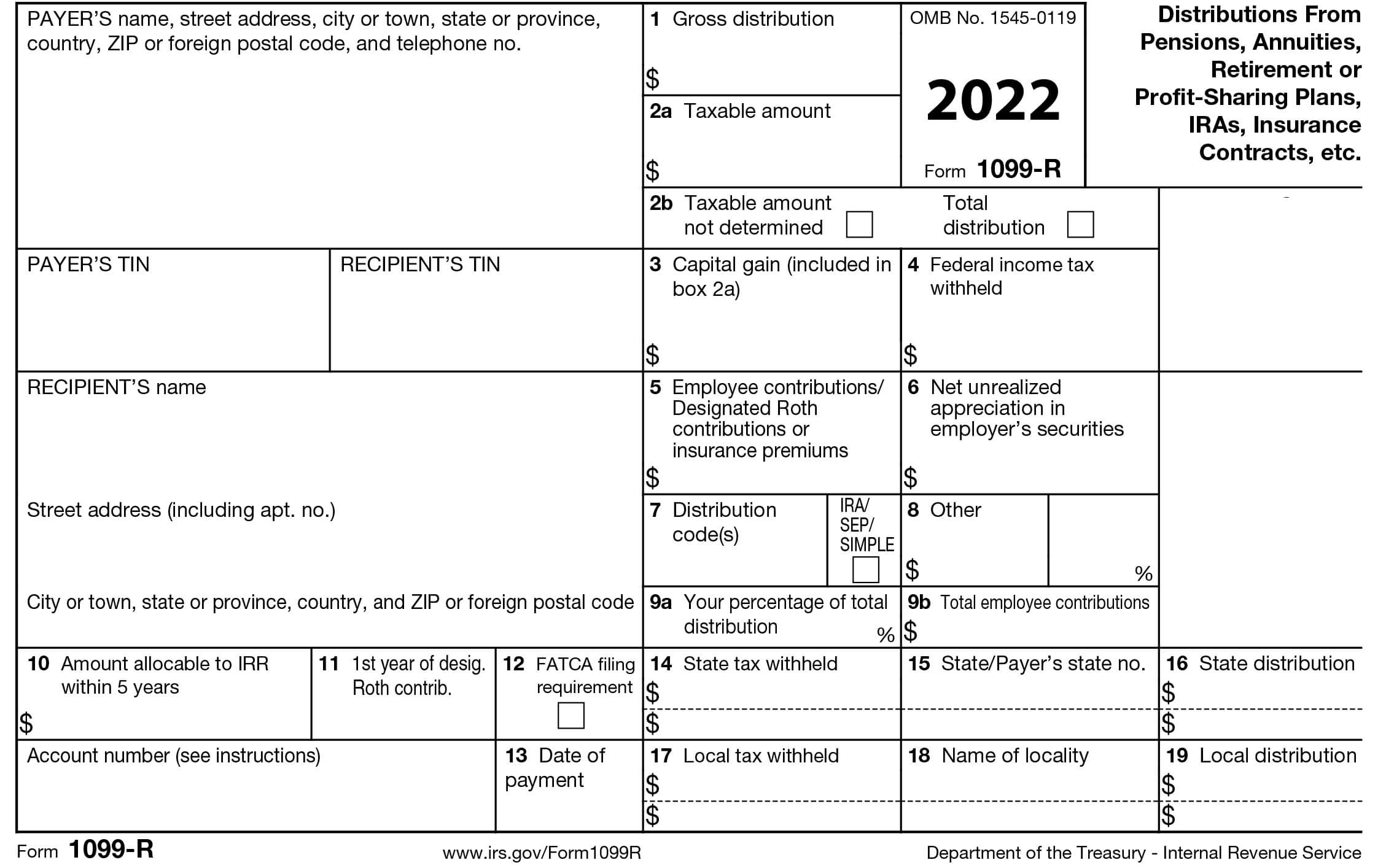

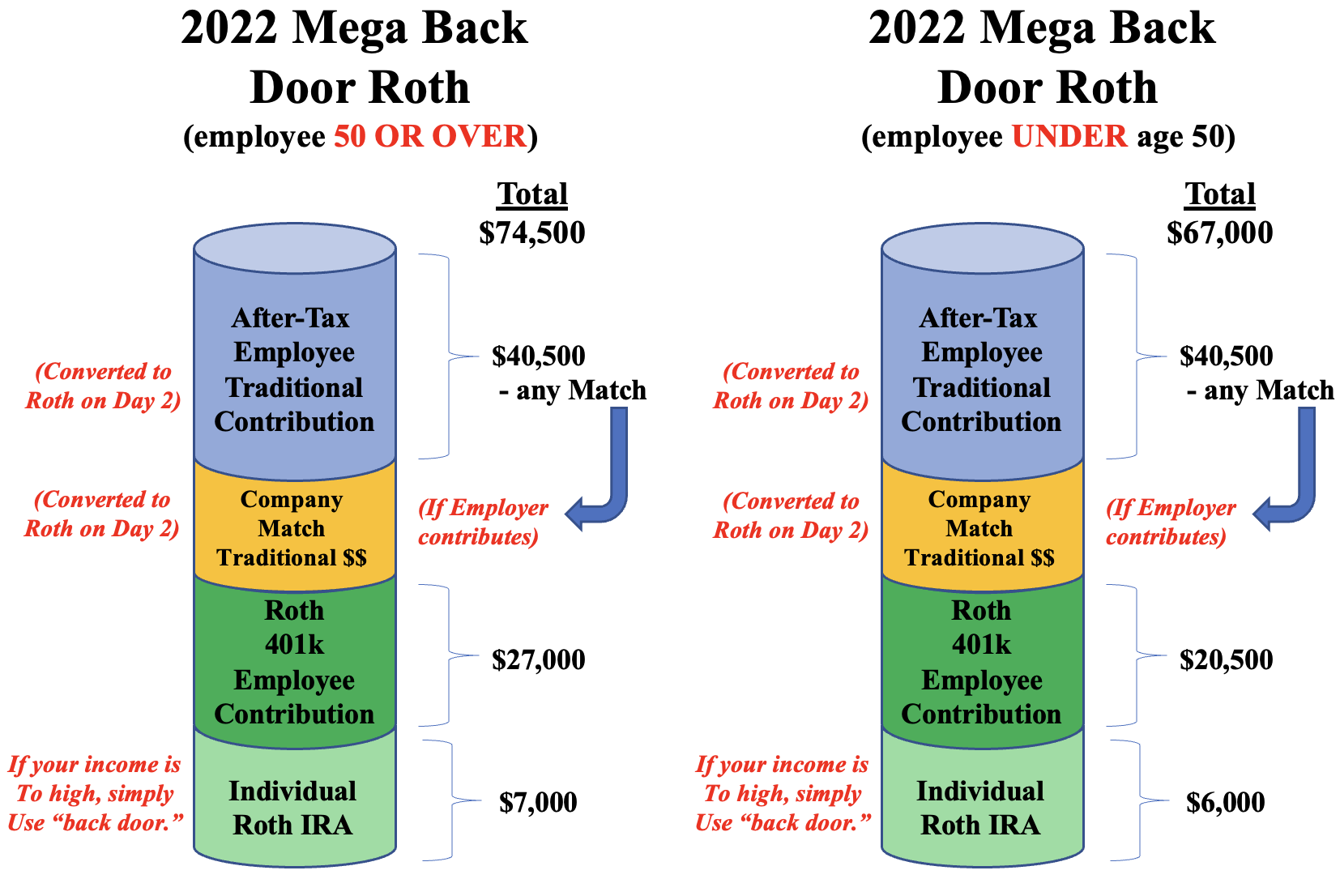

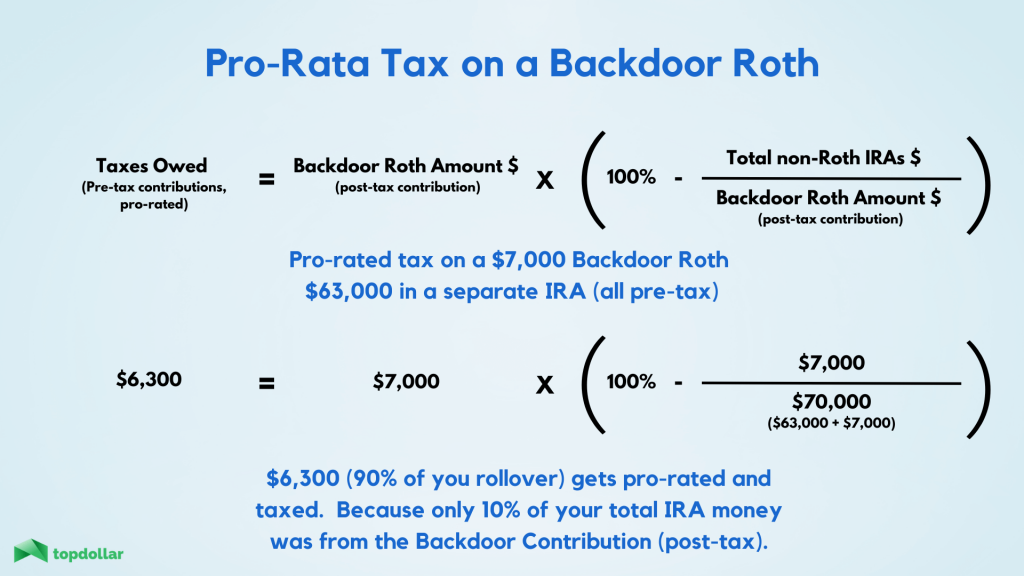

Backdoor IRA Gillingham CPA, In 2024, the contribution limits rise to $7,000, or $8,000 for those 50 and older. This move also excludes nondeductible ira funds.

Source: markjkohler.com

Source: markjkohler.com

The Magic of the Mega Backdoor Roth Mark J. Kohler, Another situation where a conversion might be worthwhile is if your income is too high to contribute to a roth ira directly. The backdoor roth ira is a legal way around income limits.

Source: millennialmoneyveteran.com

Source: millennialmoneyveteran.com

Backdoor Roth IRA Conversion Overview and StepbyStep Guide, Is the backdoor roth allowed in 2024? So if you want to open an account and then use the backdoor ira method to convert the account.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, ($161,000 for single filers in 2024,. The conversion will happen in 2024, therefore the step 2:

Source: www.fidelity.com

Source: www.fidelity.com

Roth IRA conversion What to know before converting Fidelity, 2024 ira contribution limits announced; A backdoor roth ira is just a name for a strategy of converting nondeductible contributions in a.

Source: www.carboncollective.co

Source: www.carboncollective.co

Backdoor Roth IRA Meaning, Setting up One, Advantages & Risks, [1] if your income is above the limit, a. In a roth ira conversion, you can roll.

In 2024, The Contribution Limits Rise To $7,000, Or $8,000 For Those 50 And Older.

Another situation where a conversion might be worthwhile is if your income is too high to contribute to a roth ira directly.

Enter The Conversion From A Traditional Ira To A Roth Ira Will Have To Be Reported On Your 2024.

In this case, only complete step 1 below for your 2023 taxes.