Arizona Tax Due Date 2025

Arizona Tax Due Date 2025. Use our income tax calculator to find out what your take home pay will be in arizona for the tax year. If you make $70,000 a year living in new hampshire you will be taxed $7,660.

To stay up to date with evolving industry processes and regulations, we place a heavy emphasis on continued education and the consistent adoption of new technologies. You can quickly estimate your arizona state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare.

The New Property Tax Rate Is 1.16, Or $116 For Every $100,000 Of Home Value.

The majority of deadlines listed here are for tax year 2023.

Individuals Who Did Not Make These Payment On A Timely Basis May Owe A Penalty.

Missing deadline incurs penalties under section 234f.

Aztaxes.gov Allows Electronic Filing And Payment Of Transaction Privilege Tax (Tpt), Use Taxes, And Withholding Taxes.

Images References :

Source: taxfoundation.org

Source: taxfoundation.org

Arizona Lawmakers Deliver Tax Cuts and Federal Conformity, Your 2023 individual income tax return is due by midnight on april 15, 2024. For individuals who filed a timely arizona form 204 for an automatic extension to file, the due date for an arizona tax return is october 15, 2024.

Source: www.youtube.com

Source: www.youtube.com

AZ Tax Liens and Tax Foreclosures Arizona Real Estate License Exam, This rate applies to taxable income earned in 2023, which is reported on state tax returns filed in 2024. Use our income tax calculator to find out what your take home pay will be in arizona for the tax year.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

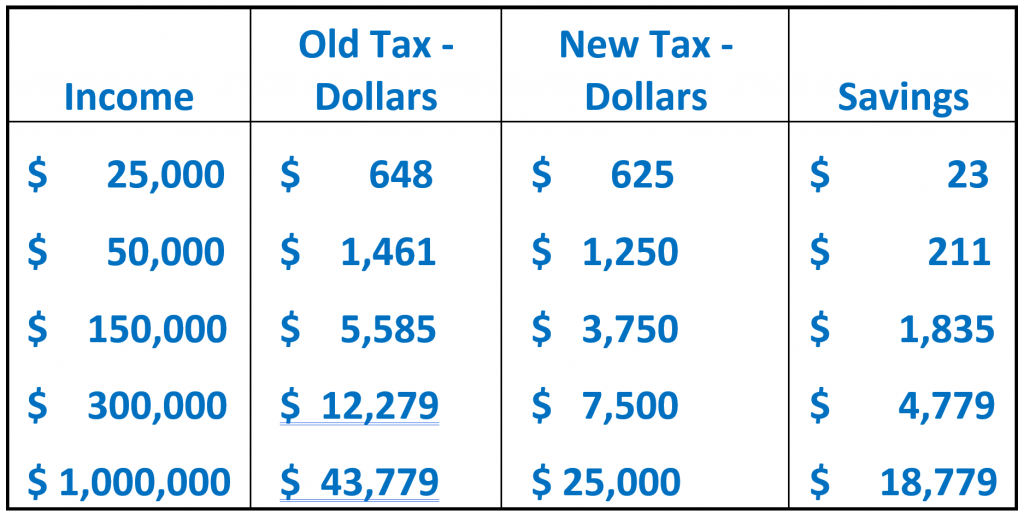

Fastest Tax Arizona Calculator 2022 & 2023, This enables us to effectively innovate, grow as individuals, and provide faster, more accurate solutions and due diligence for our partners. This rate applies to taxable income earned in 2023, which is reported on state tax returns filed in 2024.

Source: news.nau.edu

Source: news.nau.edu

What is Arizona’s new flat tax and what does it mean for you? The NAU, This rate applies to taxable income earned in 2023, which is reported on state tax returns filed in 2024. Phoenix, az—the arizona department of revenue (ador) is now accepting individual income tax returns for tax year 2023 marking the beginning of.

Source: www.zrivo.com

Source: www.zrivo.com

How To Make Arizona Estimated Tax Payments Online?, The final day to file your tax returns in arizona is april 18. You can make an extension payment online by.

Source: www.youtube.com

Source: www.youtube.com

Arizona Cities to Stop 🛑 Charging Rental Taxes Starting in 2025 YouTube, This rate applies to taxable income earned in 2023, which is reported on state tax returns filed in 2024. The majority of deadlines listed here are for tax year 2023.

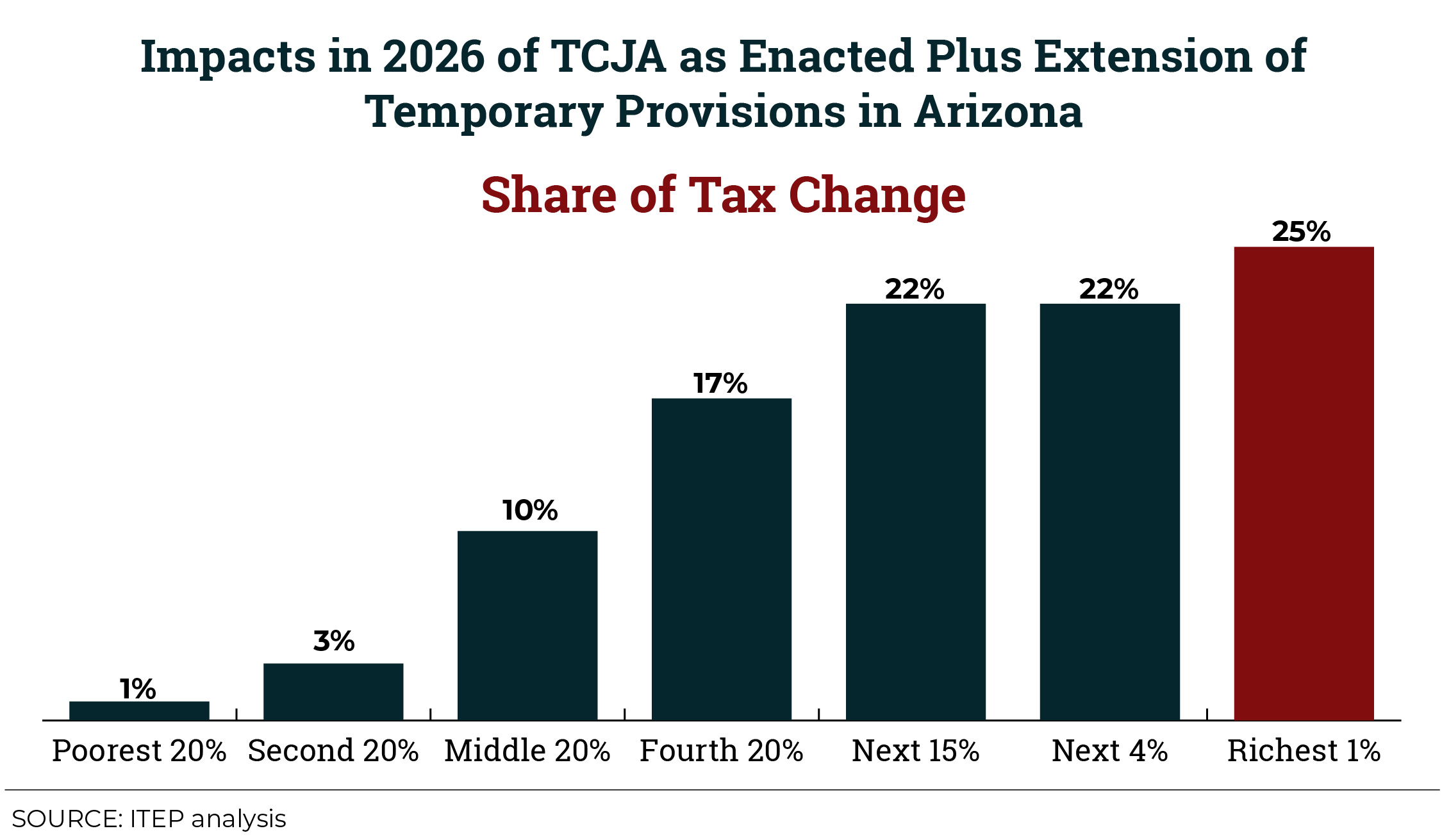

Source: itep.org

Source: itep.org

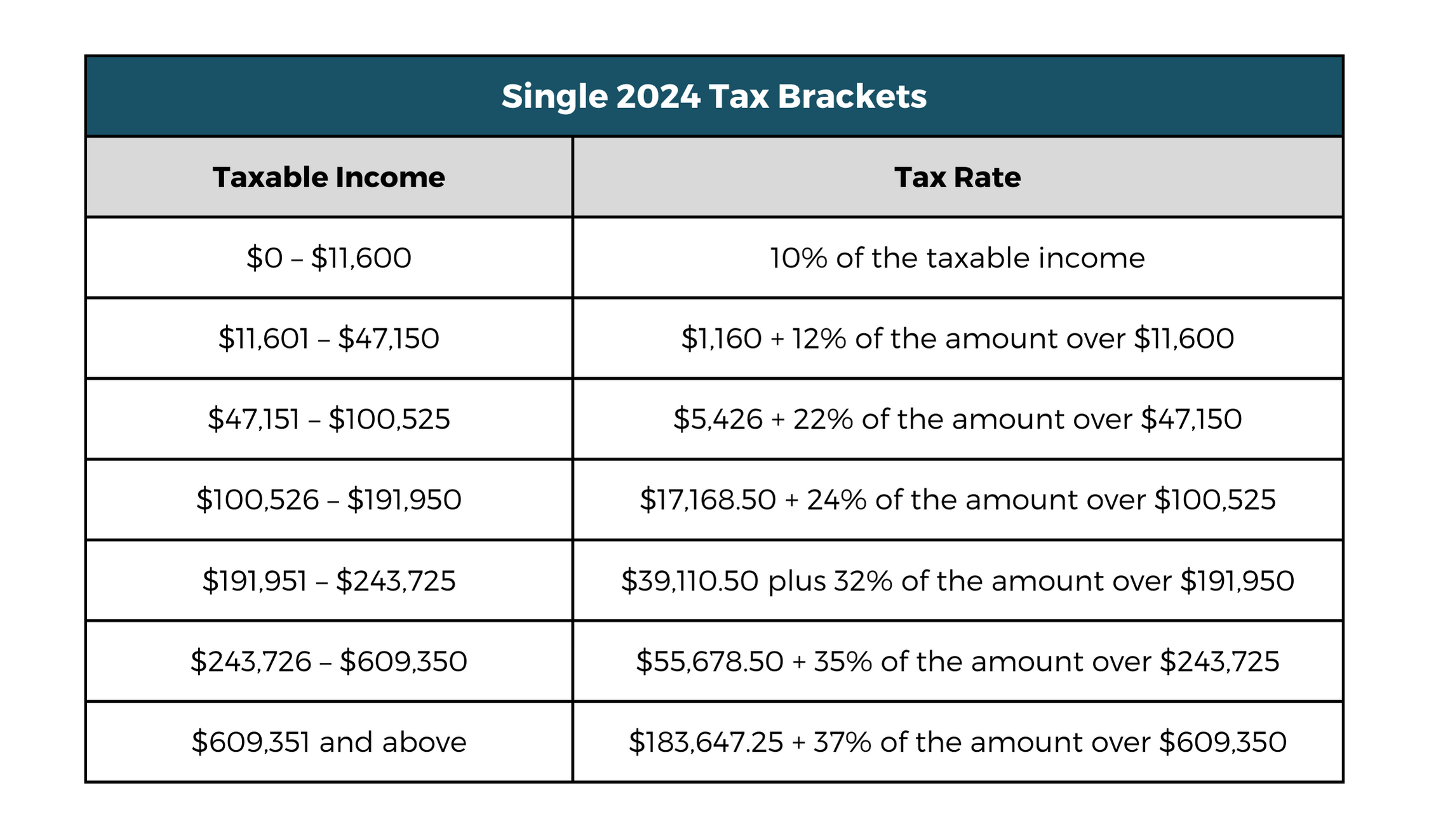

Tax Cuts 2.0 Arizona ITEP, The 2024 tax rates and thresholds for both the arizona state tax tables and federal tax tables are comprehensively integrated into the. Some apply to upcoming tax years and some are irs or federal deadlines.

Source: www.fennemorelaw.com

Source: www.fennemorelaw.com

Arizona Tax Increase, Estimated Tax Payments, and Proposition 208, Enter your details to estimate your salary after tax. 2024 tax calculator for arizona.

Source: imagetou.com

Source: imagetou.com

Tax Rates 2024 2025 Image to u, Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. The new arizona flat tax rate is a tax cut for all arizona taxpayers,.

Source: www.taxuni.com

Source: www.taxuni.com

Arizona Transaction Privilege Tax, You can make an extension payment online by. Payment for taxes for the fiscal year 2024 is due by march 15, 2025.

Starting In Late 2024, Landlords Should Plan For The.

Individuals who did not make these payment on a timely basis may owe a penalty.

Arizona Consolidated Its Four Income Tax Brackets Into Two Brackets In 2022.

The electronic due date for tpt returns is dependent on the return and payment being timely.